- Smoothletter

- Posts

- Let’s rock let’s rock

Let’s rock let’s rock

This quarter

Hi, everyone! I usually stay far, far away from offering anything that could be construed as financial advice, being a media professional and all. But I’m making an exception today. Allocate your portfolio accordingly!

just invested in some stocks. chicken and vegetable. going to be a high yield year for soup

— madimoiselle ♡ (@drivingmemadi)

3:50 PM • Oct 3, 2023

—Kinsey, cofounder and head of editorial

P.S. We’re having a little get together on Tuesday of next week and we’d love to see you there if you’re in NYC! RSVP here ✨

Smooth’s Q4 Is Going to Rock

When you’re young, you measure the passage of time based on the school year—summer, back to school, winter break, end of school. When you’re in your 20s, you measure the passage of time based on outdoor day drinking conditions—too cold for anything but beer inside, ideal, too hot for anything but beer inside, ideal, eggnog.

But when you’re pushing 30 and running a business, you measure the passage of time on an entirely new schedule that you once mocked—quarters. This week, we’re officially in the quarter of business plenty (if you’re a business that counts advertising as any significant portion of your top line).

Welcome to Q4. The start of any new quarter—but especially the last one of the calendar year—feels like an opportunity to dial in on and recommit to what matters, and here at Smooth that’s a chance we never pass up. So today, I called in a favor from my fellow girlboss/Smooth’s COO Jenny Rothenberg, who is our team’s north star for setting, tracking, and achieving goals.

I asked Jenny to share some thoughts about Smooth’s quarterly goal-setting philosophy, and not only did she deliver a thoughtful reflection on how we’ve come to understand ambition and benchmarking, but also? She made it School of Rock themed. The girl can do it all!

Handing it over to Jenny →

Welcome to the Smooth Media School of Rock(s)

No matter how many startups tell you they can run efficiently without a kitschy operating philosophy…many of them can’t (not hardcore unless you live hardcore). That’s why Smooth is committed to running our business using the Entrepreneurial Operating System, or EOS, model.

What that is: It’s a “people operating system that harnesses human energy through a simple set of tools and principles.” AKA it’s an operating and management system centered around people. Optimizing processes, org structures, and workflows to remove bottlenecks, maximize efficiency, and (as it even says on EOS’s website) “run more smoothly [editor’s note: 😏] and profitably.”

We first learned this model during our time at Morning Brew, and clearly it had an impact. To this day, many of our daily operations and long-term strategic plans utilize EOS.

Since it’s the start of PSL season Q4, we’re going to talk about the EOS version of goals—they’re called “rocks.” Why a rock instead of a goal? Not because School of Rock is the best film ever made, but for this reason as stated on the EOS site:

“The term ‘rock’ came from an analogy in Stephen Covey’s book, First Things First. Picture a glass cylinder set on the table. Next to the cylinder are rocks, gravel, sand, and a glass of water.

Imagine that the glass cylinder is all of the time that you have during a working day.

→ Rocks represent your main priorities.

→ Gravel your day-to-day responsibilities.

→ Sand is interruptions.

→ Water everything else that happens during your day.

If you, as most people do, pour the water in first, the sand in second, the gravel in third, and the rocks in last—the rocks won’t fit. That’s your typical workday.”

The gist: It’s all too easy to get bogged down in the day-to-day and the unexpected, and then a month, a quarter, even a year passes and you still haven’t made the big stride you wanted to—you didn’t put the rocks in first.

That’s why we start every quarter by setting rocks—figuring out the biggest priorities and focusing on them for the next three months. But how do we determine those priorities, especially as a scrappy and growing business (that might also be suffering from rare blood disease, Stickittodamanneosis)? So glad you asked.

First: We write a long (and I mean long) list of the things we want to get done in the quarter. No bad ideas, anything goes.

Second: We trim that list down by asking ourselves some important questions.

Are these rocks ambitious enough? If we accomplished all or even most of these things, would we be absolutely freaking psyched? Call the quarter a success? Would Josh use his favorite word: fantastic?

Are these rocks possible? Does this goal really need to be accomplished this quarter, or are we biting off more than we can chew? Why do we need to do this now, and do we have the bandwidth and team to get it done? This is a crucial part of the rock-setting experience—less can be more. As a startup, we want to make meaningful progress every quarter instead of marginal improvements on a bunch of random things.

Are these rocks input-oriented? Nothing yours truly hates more than a vague number pulled out of you know where and calling it a “goal.” Focusing on the inputs we can control will lead us to the outputs we want (as long as we’re smart about setting those rocks in the first place). So instead of “grow by 100k subscribers on YouTube,” we’d set a rock more like “create and publish 3 YouTube Shorts per week” or “optimize thumbnail creation process to increase CTR 3x.” Focus on inputs and the results will come. If not, you chose the wrong inputs.

Would you tell Picasso to sell his guitars? IYKYK.

Third: Once we have our rocks set, we assign one (one!) owner. This doesn't mean they’re on their own to get this done, but they’re the QB. The Principal Mullins, if you will (I hope you will because I really do love School of Rock). It’s on them to push the right people or processes forward to make it happen and they’re accountable for a W or an L.

Finally: We keep ourselves honest with biweekly rock reviews. Every other week in our company-wide sync, we run through the list of rocks together and get a simple “on track” or “off track” from each rock’s owner. On track? Punk rock. Off track? We take a second at the end of the review to discuss why it’s off track and what the rock owner can to do fix that.

Bottom line: Rocks are the guiding light for startups like us that recognize there are realistic tradeoffs in a world that moves really fast and changes all the time. When things get chaotic, we have our rocks to help us figure out what to prioritize. May everyone in media and beyond embrace the glory of rock and have a bangin’ Q4.

Dirt (the media co behind one of my favorite newsletters) acquired the design newsletter Sitting Pretty. This rebundling-adjacent micro-M&A media trend is super interesting as a strategic option for creators who want to make stuff without being a CEO.

Former CNN head Jeff Zucker purchased a minority stake in Front Office Sports that values the company at $40 million, up from $25 million at the end of 2021.

Space media company Payload hit $1M in advertising revenue this year.

Slow Upload shared an insightful dispatch from the east coast version of VidCon, which seemed focused on the creator industry growing up.

#digibuzzcodevoxious is a term we coined back in our Morning Brew days—a portmanteau of Digiday, BuzzFeed, Recode, Vox, and Axios. Obviously, the year was 2018 and the interest rates were zero. But still, the sentiment of “interesting media trends and news” remains. So the name stays.

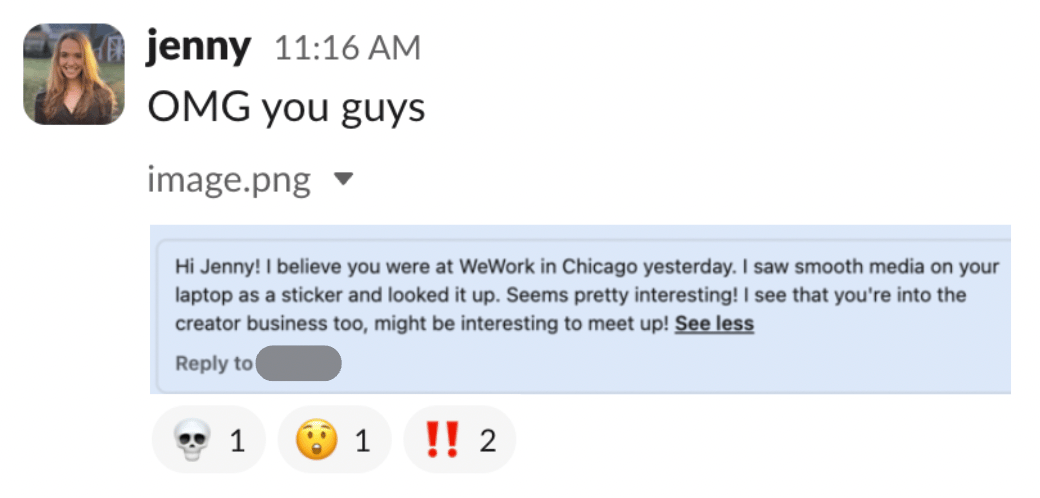

The Smooth stickers Jenny insisted we get for “brand marketing” purposes…might…work? DM if you want one.

Thanks for reading! Heads up, Spotify Wrapped stops collecting your listening data at the end of this month. So queue wisely if you, too, have spent most of this year listening to Christmas Classical Piano.